Stats SA ‘grossly underestimating’ construction sector activity

Advertising

11-12-2020

Read : 489 times

Moneyweb

Source

Economist Roelof Botha has no doubt that Statistics South Africa (Stats SA) is grossly underestimating the level of construction sector activity in South Africa.

Botha on Thursday questioned how there can be a 21% decline in official value added by construction in the third quarter of 2020, but a 14.5% increase in the value of wholesale sales of construction and building materials.

“This is a contradiction,” he said. “What I like about the wholesale sales figures is that we are talking about R36 billion in expenditure in one quarter. This is not Mickey Mouse value.”

Botha believes Stats SA is underestimating construction sector activity for the simple reason that its surveys do not reach and reflect the size of informal construction activity in the country, particularly in rural areas and the outskirts of metropolitan municipalities.

Botha was commenting on the Afrimat Construction Index for the third quarter of 2020, which was released on Thursday.

The composite index of the level of activity within the building and construction sectors, compiled by Botha on behalf of Afrimat, staged “a remarkable improvement” to an index value of 115.9 in the third quarter (Q3) of 2020 after dropping to an unprecedented low of 68.6 in Q2.

Botha said the index currently is higher than the value of 103.7 recorded in Q1 and only marginally lower than the level of 117.4 recorded in Q4 of 2019.

Mixed signals about sector recovery

The encouraging rebound in the Afrimat Construction Index follows other data providing mixed signals about the industry’s recovery and performance post Covid-19.

Construction market intelligence firm Industry Insight reported a strong rebound by the civil construction sector post Covid-19, with the value of civil projects awarded in November 2020 increasing to the highest level in four years and 21% higher year-on-year compared with the same month last year.

However, it said the private sector continues to disinvest in buildings, with approvals for private sector construction dropping by 10.7% year-on-year in September and project postponements accelerating.

Confidence up

FNB and the Bureau for Economic Research (BER) reported this week that confidence in the civil construction industry improved in Q4 of 2020 to 16 on a 100-point scale from 11 in Q3 and only five in Q2.

FNB/BER reported last week that confidence in the building industry increased in Q4 of 2020 to 29, its joint best level since the end of 2018, from 24 in the previous quarter and four in Q2.

Only two of the nine constituent indicators in the Afrimat Construction Index achieved positive growth in Q3 of 2020 compared to the corresponding quarter in 2019.

Wholesale trade sales (construction) grew by 14.5% and retail sales (hardware) by 12.3%.

Declines

By contrast, there were declines in buildings completed (value) of 47.4%, building plans passed (value) of 29.8%, construction value added of 21.6%, employment in construction of 19.3%, building materials (volume) of 14.9%, salaries and wages (construction) of 14.7% and building materials (sales) of 9.6%.

Botha said the systematic lifting of most of the lockdown regulations has led to a V-shaped recovery for most key sectors of the economy, including construction.

“Despite disappointing third quarter GDP data on the construction sector, published by Statistics SA on December 8, it seems clear that retail and wholesale trade sales for hardware and building materials are fuelling the recovery in the construction sector,” he said.

Botha said hardware and wholesale sales of building and construction materials both recorded one of their five best index values since 2011.

He said most economists expect GDP growth of between 3% and 4% during 2021, which could provide the momentum required for sustained growth from 2022 onwards.

Growth phase for SA

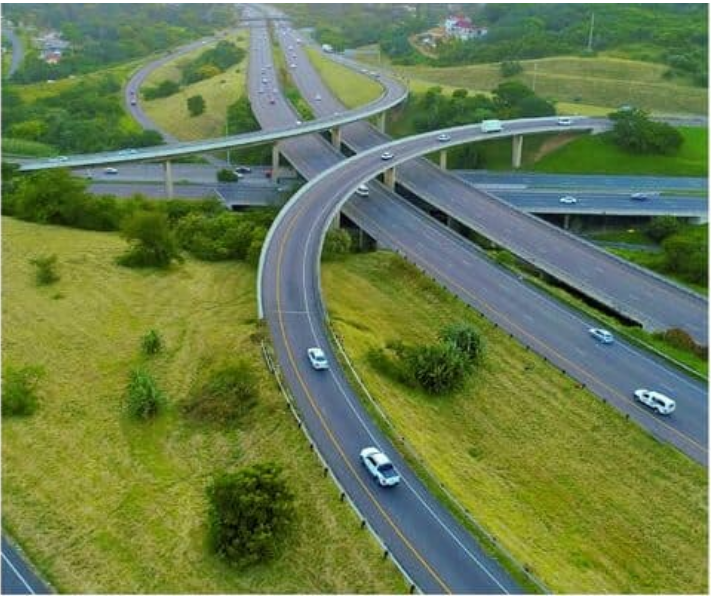

Botha believes South Africa is now on the verge of another construction-led economic growth phase.

He said hardly anybody in 2004 expected the South African economy to grow at around 5% a year for the next four years and part of the economic success prior to the financial crisis of 2008/09 was related to the low-cost housing drive under the Reconstruction and Development Programme.

“It can happen again,” he said.

Botha believes a number of significant growth drivers have appeared that promise to boost construction activity during 2021, including the government’s infrastructure investment plan and interest rates currently being at a 50-year low.

However, he said building plans passed year-to-date are almost 30% lower than last year, because of the slowness with which the Deeds Office and municipalities started recovering from the lockdown.

“That has to get back above 100 if you think about the low interest rates, population growth and the infrastructure programme.

“By more or less the second quarter next year I expect without a shadow of a doubt the Afrimat Construction Index to set a new record,” he said.

Botha is unconcerned about the government’s ability to finance its infrastructure investment plan to stimulate the economy post Covid-19.

He said most of the 62 strategic infrastructure projects and special projects do not require direct fiscal assistance, although some indirect fiscal assistance will be needed for some infrastructure expenditure at municipal level.

“I’d like to believe that the government can redirect unnecessary expenditure into those channels where you need, for instance, to make sure that you have access roads or to expand the grid to meet the requirements of more electricity consumption and things like that,” he said.

Recent News

Here are recent news articles from the Building and Construction Industry.

Have you signed up for your free copy yet?