SANRAL Signs R7bn Loan with New Development Bank to Fund Toll Portfolio Projects

Advertising

23-07-2025

Read : 99 times

Arrive Alive

Source

The South African National Roads Agency SOC Limited (SANRAL) has successfully signed a R7 billion loan agreement with the New Development Bank (NDB) to support its various toll portfolio projects in the country.

Speaking at the official signing ceremony of the loan agreement in Sandton, Johannesburg, today (Tuesday), SANRAL Board Member Mahesh Fakir said that SANRAL is looking forward to the positive impact that will emanate from the long overdue funding. He also said that the funding will greatly assist the road agency to carry out its mandate.

“This loan agreement comes against the backdrop where the South African Government under President Cyril Ramaphosa will be spending almost a trillion rand in the next three years on the development of our country’s infrastructure. We are proud to be able to say that we are going to spend these funds on our road infrastructure projects, with key road works such as upgrading our national roads, widening carriageways, building extra lanes, as well as many other aspects that relate to road infrastructure,” said Fakir.

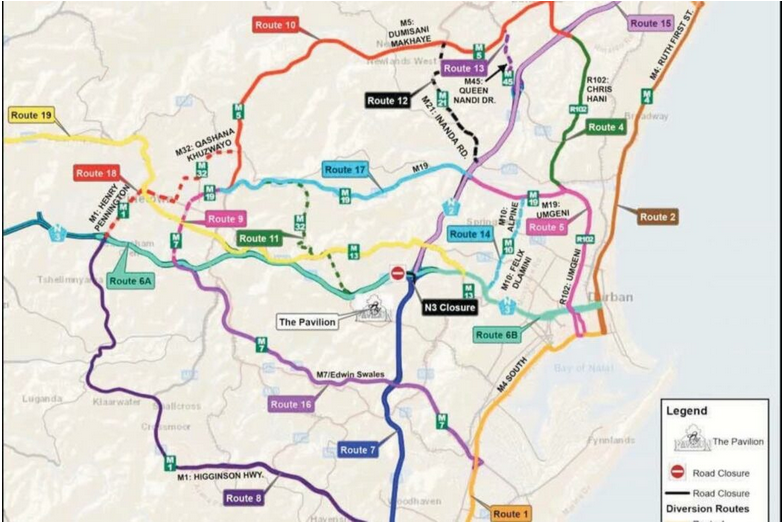

Fakir also said that key projects that will be funded through the NDB loan include the N3 Paradise Valley to Marianhill Toll Plaza, N3 Marianhill Toll Plaza to Key Ridge, N1 Zandkraal to Scottland, and the N1 Scottland to Winburg South project.

These four projects represent over R12.7 billion in investment, with more than R3.8 billion reserved for SMMEs and targeted enterprises, close to R1 billion in labour-driven economic inclusion, and far-reaching logistical, safety, and mobility enhancements for South Africa’s most important trade routes. These projects are expected to create an estimated 6600 job opportunities for local communities that live alongside them.

“As part of our ongoing efforts to support our government’s drive to achieve higher levels of economic growth, SANRAL will continue to implement strategic projects across the country and undertake massive investment in new infrastructure projects, while also upgrading and maintaining the national roads infrastructure projects that fall within its ambit. The loan agreement will support and allow SANRAL to continue paving the way to progress for the South African economy and society in general. SANRAL is looking forward to the positive impact that will emanate from the long overdue funding that will greatly assist the entity carry out its mandate,” said SANRAL’s Chief Executive Officer, Reginald Demana.

Demana also added that the loan will become effective as soon as the standard conditions precedent have been met. The balance of the borrowing limit (pegged at R16.5 billion) approved by National Treasury not utilised by the NDB loan will be used to raise funding in the domestic market, including, but not limited to bonds, and syndicated and bi-lateral loans, he said.

According to Monale Ratsoma, the NDB’s Vice President and Chief Financial Officer, new economic opportunities will be provided for ordinary South Africans through the loan agreement with SANRAL.

“We are here together as partners that share a common vision for South Africa’s future. As the NDB, we are fully behind the mandate of SANRAL to improve people’s lives and enable much needed commerce through the provision of quality road infrastructure. The NDB is also proud that the financing offered is denominated in local currency. This will provide the necessary cushioning against currency fluctuations, which often tend to reduce the benefits of the support offered and increase overall risk to the fiscus and corporate balance sheets if not adequately hedged. As the NDB, we have a deliberate focus in providing local currency financing to our partners,” said Ratsoma.

President Ramaphosa announced during this year’s State of the Nation Address (SONA) that the South African Government continues to engage local and international financial institutions and investors to unlock R100 billion in infrastructure financing.

A project preparation bid window has been launched to fast-track investment readiness. This includes revised regulations for public-private partnerships, which will unlock private sector expertise and funds. Government will spend more than R940 billion on infrastructure over the next three years. This will include R375 billion in spending by SOEs. This funding will revitalise South Africa’s roads and bridges, build dams and waterways, modernise our ports and airports, and power the country’s economy, President Ramaphosa added.

Recent News

Here are recent news articles from the Building and Construction Industry.

Have you signed up for your free copy yet?