Heroes building new-look townships

Advertising

25-10-2010

Read : 105 times

Moneyweb

is there money in it? calgro m3 says yes.

dozens of companies have succumbed in the housing market over the years but, after an r8,3m first half headline earnings improvement, calgro m3 (jse:cgr) brims with confidence.

remember corlett drive, mondorp, bester brothers and, more recently, pinnacle point (jse:png), abelangani and sea kay holdings (jse:sky)? no wonder that by association, calgro m3 trades at a third of real net asset value.

reporting headline earnings of r4,6m in the six months to august, compared to r3,7m in the comparative period of 2009, ceo ben pierre malherbe sees prosperity ahead.

there's something heroic in the work these companies do. at r56 000 a pop, rdp houses are an improvement on the matchboxes offered by the nat's pre-1994. they are small but have running water, sewerage and electricity. there's a bit of variety - semi-detached homes and small blocks of flats up to four storeys high.

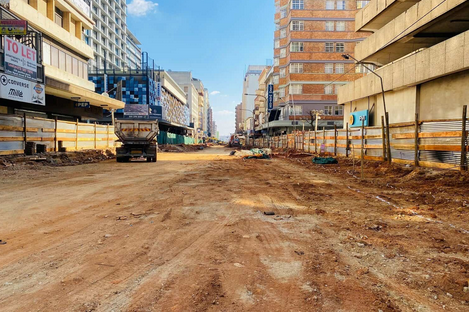

the new-look sa township is a far cry from the old apartheid model. today's townships have clinics, creches, schools, libraries, community centres. playing fields and open spaces. churches rush in where angels fear to tread, followed by shoprite (jse:shp) and other adventurous retailers. in short, the new-look suburbs might be "affordable" but they are decent.

calgro m3 is a small company but its heroic work involves big money. for a company with a current order book of r4,8bn and work in the pipeline worth another r7,2bn, calgro m3's total assets of r364,8m look small. headline earnings of r4,6m in a half year (2009:r3,7m loss) seem scant reward.

but that might be the point - serious upside from here!

malherbe is encouraged that in pravin gordhin r787bn infrastructure spending plan for the next three years, r40bn has been set aside for housing.

in addition, demand is strong for bonded housing in the r100 000-r350 000 bracket. calgro m3 works with all the banks in arranging funding for employed private buyers.

another positive is that if you can't sell a house these days, it is dead easy to rent it - such is the pent up demand for accommodation.

after so much attrition in the market calgro m3 faces little competition. it has focused largely on gauteng and made a point of becoming a partner of the johannesburg council.

"we try to short-circuit the normal process by finding well-located land and buying it ourselves, rather than waiting for council to come up with the land. that can save literally years."

the company takes care not to spend on land until it has a memorandum of understanding from the council. after proclamation, services are installed and marketing starts. the first money comes in after stands (or the whole township) are transferred. then building of "top structures" goes ahead at the rate of 300 units a month and final payment comes from government or the bank.

calgro can build the "top structure" with its own construction team but services are installed by big five construction groups, who contract separately with the council. calgro limits the size of a project it undertakes.

because all three tiers of government spent so much on the world cup, the gautrain, rea via, etc in the past three years, there has been little money for housing, hence the desperate straits of sea kay.

there is a consolation says malherbe.

"the world cup and, before that, the eskom crisis, saw to it that the council has improved electricity supplies, as well as water and sewerage connections."

calgro m3's share price has languished because everyone has a negative view of township development these days.

some 80% of calgro's work is in affordable housing. the balance comprises smart houses of up to r1,6m in areas like broadacres and hartbeespoort dam.

with its new fleurhof township comprising 3100 homes between main reef rd and meadowlands less than 10km from the johannesburg cbd, calgro m3 gave the land to the johannesburg council in a trade off for quick water and electricity connections. next comes a 4 199-unit development near jabulani mall.

its pennyville project comprises 2 800 units and is almost complete. calgro built the crèche free of charge as part of its corporate social investment.

township construction throws our social setup into sharp relief. those in the bonded houses are virtually all gainfully employed. those in the rdp houses are mostly on social grants. many have given up looking for work. others fear losing grants if they get a job and sit in the sun. calgro takes pains not to let the divide between the bonded houses and the rdp sections appear too stark, prettying up rdp sections.

calgro m3 is owned as to 25% by mvua properties, khusela investments and black management.

never mind that turnover in the six months to august dropped 15% to r96,2m and that operating profit fell 75% to r6m (r24,3m). because of the long lead time between buying a piece of land, servicing and marketing it and collecting the proceeds, this company will always need cash. debt:equity is down to 1,3 to 1 from 1,6.

last first half there was a profit on an investment of r25,3m, which was deducted for the headline earnings calculation. that capital profit was just an ifrs entry but it might tell a story.

international housing services, an offshore housing funder, paid r30m for a 30% stake in fleurhof, calgro m3's next big project. that valued just this project at r100m. if you apply that type of valuation to the rest of the company's projects, you would certainly get to a large premium on asset value.

Recent News

Here are recent news articles from the Building and Construction Industry.

Have you signed up for your free copy yet?