Offshore jobs keep construction groups afloat

28-03-2018

Read : 60 times

Business Live

Source

Consolidation in the sector could bring construction companies back into vogue

Offshore work should sustain local listed construction players as they grow impatient at the slow infrastructure spend and lack of new projects in SA.

Murray & Roberts, Aveng and Wilson Bayly Holmes-Ovcon (WBHO) have undertaken new projects in Australia and other offshore jurisdictions.

Australian revenue accounted for 61% of WBHO’s group revenue in the six months to December. CEO Louwtjie Nel says while JSE-listed construction groups like WBHO are committed to continuing to do business in SA, they have to operate in other markets in order to survive.

In the past five years or so government spending on infrastructure has slowed significantly. From a private sector point of view, most work had been related to the building of new shopping centres but this is now in the past.

"SA is overshopped now. We were involved in various retail projects, including the Mall of Africa, but currently all our South African work is not in retail. We need infrastructure spending to come back but until then our main revenue drivers are offshore, where we can compete for large projects."

Listed construction group Aveng has also recognised opportunities offshore. Eric Diack, executive chairman and acting CEO of Aveng, commented in February on the group’s results for the six months to December that its McConnell Dowell civil engineering operations, which service Australasia, were a crucial business to ensure the company was profitable.

The engineering investment’s revenue grew 35% in that reporting period.

Electus equity analyst Mish-al Emeran says construction groups have struggled to build their order books.

"Private-and public-sector fixed investment spend has been under pressure, especially government spend on large public sector projects.

"To a large degree it’s been a case of construction companies running down existing order books but finding it tough to grow their existing order books, so the medium-term outlook does not look good, on average."

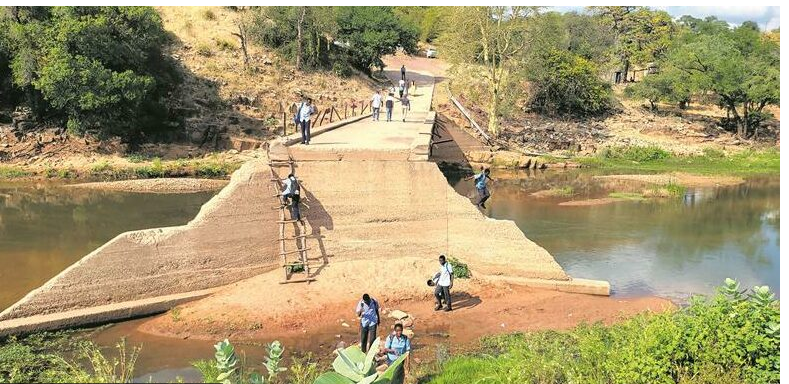

Roads and earthworks is one area where there has been some new work, but competition grew and weighed on margins. Various private operators have taken road work business from listed players.

Emeran says even though Australia is highly competitive, the amount of work available there has helped South Africans to enter the market.

"Due to the slow local environment, companies have been searching for growth outside of SA, and Australia was one geography that attracted some of the SA’s listed players. Some work was also being done in the Middle East and the Americas but Australia stood out as the offshore destination of choice. WBHO, Aveng and Murray & Roberts have been exposed to civils-related work there, with Murray & Roberts specifically targeting the oil and gas industry. WBHO now also is building a presence and is involved in the construction of commercial real estate in Australia," Emeran says.

The construction sector itself has shrunk in terms of market capitalisation over the past few years, and many fund managers and stock brokers have turned away from the sector given its lack of liquidity in some cases and lack of sizable returns.

Avior Research says that none of its team of analysts are focusing on construction companies. "They haven’t been popular with investors for a while and have not been on our radar. This may change in the future," the group says.

A move that could bring construction companies back into vogue would be consolidation in the sector.

On Monday, German investment group Aton announced it intended to take over Murray & Roberts, acquiring the 70% of the group that it did not already own.

There has been speculation in the market that Group Five could be a potential takeover target. In 2017 real estate and infrastructure fund owner Greenbay Properties tried to buy Group Five’s European assets but the offer lapsed with Group Five saying the bid undervalued its assets.

Emeran says consolidation could occur only if targeted companies have attractive order books. Some of the listed players have been forced to pull out of contracts,

"Currently, consolidation in the construction sector is not coming, because the contracts are key and if businesses lose their contracts there often is not much else worth buying," he says.

Recent News

Here are recent news articles from the Building and Construction Industry.

Have you signed up for your free copy yet?