Basil Read 7.5% down on interim loss, rights offer

29-08-2017

Read : 120 times

Moneyweb

Source

Strong order book ‘promises return to profit’.

The share price of struggling construction group Basil Read dropped by 7.5% to 74c late on Monday after interim results showed the group is trading at a considerable loss.

The share has lost more than 64% of its value in the year to date.

With the announcement of the interim results Basil Read also informed the market that it plans a rights offer to raise R200 million to R300 million as part of a funding plan to ease “critically tight” liquidity, stabilise the group and fund operations. Acting CEO K2 Mapasa told Moneyweb the group hopes to finalise the rights offer by the end of the calendar year.

Basil Read on Monday reported that revenue from continuing operations dropped from R2.5 billion in the six months ended June 30 last year to R2.3 billion. The order book stood at R10.7 billion at the end of the reporting period, compared to R10.4 billion in the comparative period.

This, however, translated to an operating loss of R458.8 million for the six months ended June 30, compared to R73.5 million operating profit for the six months ended June 30 2016. The net loss amounted to R474.1 million compared to a net profit of R34.4 million in the first six months of 2016.

The group recorded headline loss per share of 295.16c, compared to headline earnings per share of 53.39c in the comparative period.

The share price was unchanged at 80c by midday on Monday.

Addressing the group’s going concern status, Basil Read said: “The board recognises that cash flow is critically tight, and that raising new funding is now essential to stabilise the company in the short term, and to meet future operating commitments over the medium to long term.”

The group’s interim results reflect an impairment loss of R88.9 million, which reduces the carrying amount of the goodwill for the roads unit to zero. Total provisions amounted to R506 million, including R485 million contract provisions of which R199 million relates to “onerous contracts”.

Borrowings increased dramatically and cash at the end of the period dropped from R219.2 million a year before to R174.2 million by June 30.

The board nevertheless stated that based on plans implemented by management the group will have enough cash for the foreseeable future.

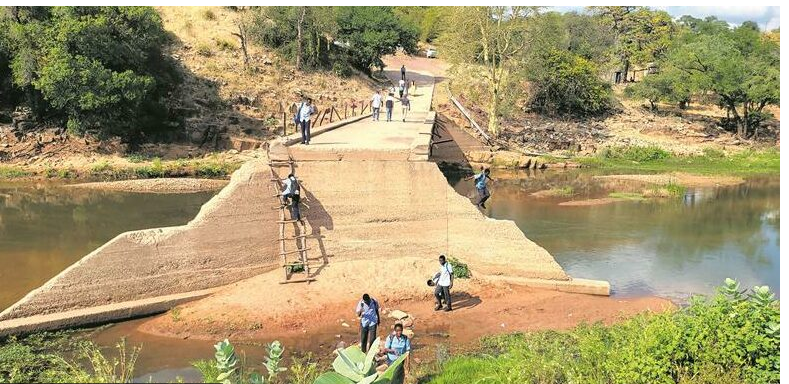

Of the group’s five operating units three recorded an operating loss, namely construction, roads and St Helena where the group was involved with the construction of the island airport and related projects.

Mapasa ascribed the loss on the St Helena project to currency fluctuations post Brexit and unexpected demobilisation costs that were not taken into account in the 2016 financial results.

Mining and developments did well, developments on the back of good sales in industrial developments.

Regarding the funding plan, the Industrial Development Corporation (IDC) has granted the mining division R90 million funding. R61 million of a R150 million bridging finance facility has been approved for the short term and in the long term the R200 million to R300 million rights issue will address the funding needs.

The group said it has not yet secured any binding commitments for the rights issue, but engagements so far suggest shareholder support.

“Internally, we have engaged in a number of initiatives to secure further liquidity. These will be in addition to increased intensity of claims recovery and comprise disposal of non-core assets, which are estimated to yield up to R150 million,” the group said.

Mapasa told Moneyweb he is excited about the group’s R10.7 billion order book, up from R10.4 billion a year ago. This includes R3.1 billion construction work, R1.9 billion roads, R1 billion from developments and R4.7 bilion in mining.

He said the St. Helena project has done well for Basil Read over the life of the project and proves that Basil Read can successfully execute complex projects. The construction of the bulk fuel supply will be completed by May next year and the group will continue to operate the airport for a further nine years on a cost-plus basis.

Two African countries have approach Basil Read for airport-related work, Mapasa said. One of these is a greenfields project and the other an expansion.

He said the group now has to focus on executing its order book well.

The positive movement in commodity prices bodes well for Basil Read’s successful mining segment and the construction of infrastructure, Mapasa said. While the construction environment is challenging the group won additional work worth R1 billion for the next two years at Eskom’s Medupi and Kusile power stations. He point out that Basil Read was able to leverage its position as incumbent on the site and concluded the contracts at acceptable margins.

The roads market is currently very competitive and margins on Sanral contracts are very thin, Mapasa said. The group therefore focusses on the rehabilitation of toll roads which are operated by private companies and offer better terms.

The group said potential profit of the order book is good and should allow the company to improve profitability.

Basil Read has not yet appointed a permanent CEO since the departure of Neville Nicolau in May. The head of the mining division K2 Mapasa has been acting in the position since June 1.

Recent News

Here are recent news articles from the Building and Construction Industry.

Have you signed up for your free copy yet?