African building boom lures cement giants to circle around PPC

27-10-2017

Read : 38 times

Moneyweb

Source

South Africa’s biggest cement maker, PPC, is an unlikely candidate for a takeover battle.

The supplier of building materials reported a loss in its last fiscal year, doesn’t have a permanent chief executive officer and its home market has just come out of recession. Still, potential bidders are circling.

PPC has received one formal offer from Canadian insurer Fairfax Financial Holdings, which has pledged to buy a stake on condition it agrees to merge with a local rival. Other companies monitoring the situation include Switzerland’s LafargeHolcim, the world’s biggest cement maker, Dublin-based CRH and Titan Cement of Greece, people familiar with the matter have said. Nigeria’s Dangote Cement Plc is also watching closely.

While the potential buyers have all declined to comment on the current status of their interest, PPC has given Fairfax until Nov. 22 to post its offer to shareholders. That will allow other bidders time to do due diligence on the company — which has a market value of R10.8 billion ($768 million) — and decide whether to proceed with a counteroffer, PPC said Oct. 3.

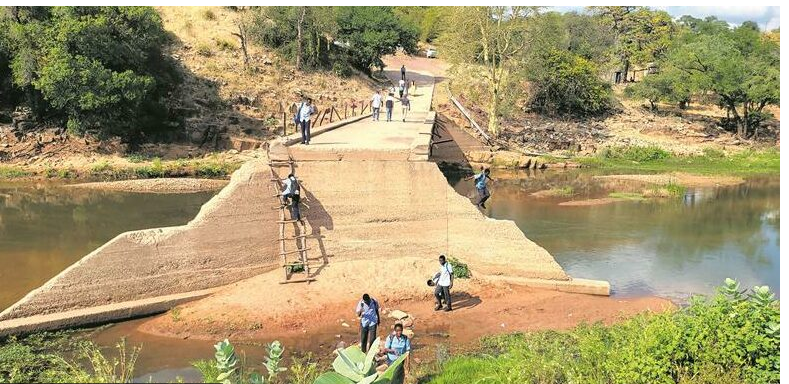

Grabbing their attention is PPC’s extensive footprint on a continent with the potential to develop infrastructure at a blistering pace in coming decades. The 125-year-old company has supplied cement for major building projects in several African countries and has expanded with new plants in Ethiopia, Zimbabwe and the Democratic Republic of Congo. Its takeover would come amid an intensifying push for consolidation in the global cement industry that has seen two deals unveiled in the last month.

“PPC has a good portfolio of assets,” UBS analyst Kwame Antwi said. “Cement consumption on the continent is lower than most parts of the world, and Africa is also likely to experience some of the most rapid urbanisation rates.”

Cement use in Africa is less than 50 kilograms (110 pounds) per person, with some countries as low as 30 kilograms, according to London-based Bloomberg Intelligence analyst Sonia Baldeira. That compares with China’s 1,737 kilograms per person and Europe’s 230 kilograms.

“You can see the huge potential that Africa represents in the next 50 years,” she said.

Notwithstanding future prospects, PPC has struggled in recent years. The supplier was forced in 2016 to raise 4 billion rand ($291 million) in a rights issue after S&P Global Ratings cut its debt to junk. The company is well capitalized for the forseeable future and doesn’t need to raise cash from shareholders a second time, Chairman Peter Nelson said in August, though the business continues to pay close attention to debt levels.

In response to their weak balance sheets, slowing demand in South Africa and expensive expansion projects, PPC and AfriSam Group, South Africa’s no. 2 cement maker, have been in on-off talks for a tie up for the past three years. Their combination has the support of the powerful Public Investment Corp, the Pretoria-based, state-owned biggest shareholder in both companies, which is seeking to create a South African industry champion. Fairfax’s offer includes a pledge to recapitalise debt-laden AfriSam on condition PPC agrees to a merger.

PPC has supplied cement for major African projects including Harare International Airport in Zimbabwe and the Congolese Trade Centre in the Congo capital, Kinshasa, while Ethiopia is in the midst of a construction boom that’s included the building of an urban railway in Addis Ababa.

Yet ramping up PPC’s operations in the Democratic Republic of Congo has proved problematic due to lower government spending amid uncertainty surrounding the timing of delayed presidential elections. Cement prices in sub-Saharan Africa’s largest country have also been depressed by cheap imports from neighboring Angola, PPC said in a presentation to investors.

Nigerian competitor Dangote made an indicative proposal to buy PPC last month, before abandoning the plan two weeks later. Yet Chief Executive Officer Onne van der Weijde said last week the Lagos-based firm retains an interest “at the right price”.

PPC shares traded at R6.78 a share at the close on Wednesday. That compares with Fairfax’s offer for R2 billion of stock at R5.75 each, indicating that investors are anticipating a higher bid. Rowan Goeller, a Johannesburg-based analyst at Macquarie, values PPC at R7 a share.

“The share price got too cheap and was trading significantly below replacement value of the underlying assets,’ UBS’s Kwame said. “Such a scenario will always attract the attention of bargain hunters.”

The market in South Africa needs consolidation, Aliko Dangote, Africa’s richest person and the owner of Dangote Cement, said in an interview with Bloomberg TV last month. His company, which already operates in South Africa through Sephaku Cement, has expanded rapidly outside of Nigeria in recent years, including into Ethiopia and Tanzania.

Major cement makers outside Africa have been in consolidation mode since the creation two years ago of LafargeHolcim from Swiss and French rivals. Last month, HeidelbergCement agreed to acquire Italian assets from Cementir Holding SpA and CRH agreed to take over Ash Grove Cement of the US for $3.5 billion.

PPC’s potential bidders are “spotting a unique opportunity to jump into South Africa and other huge potential markets, such as Ethiopia,” said Bloomberg Intelligence’s Baldeira.

Recent News

Here are recent news articles from the Building and Construction Industry.

Have you signed up for your free copy yet?