10 years ago, this company was the largest construction firm in SA. Then it lost 99.5% of its value. Here’s what happened

30-05-2018

Read : 139 times

Business Insider

Source

Aveng's share price has imploded from R65c to 33c over the past ten years.

The company was hit by the slowdown in SA construction and the commodity cycle – but it also suffered self-inflicted wounds.

A takeover offer from Murray & Roberts is not expected to be realised.

On Tuesday, Aveng announced that it is going ahead with a rights offer to issue shares worth R1.8 billion. The company, which has 15,000 employees, is in desperate need of hard cash to pay off debts of more than R3 billion.

But currently, the market values Aveng at only R171 million, a fraction of what is was worth a decade ago. Then it was the biggest construction company in South Africa, with annual revenues of more than R50 billion.

In the last ten years, its share price lost 99.5% - from R65 to 33c.

Twitter Ads info and privacy

The depressed South African construction market since the global financial crisis, the commodity market downturn (Aveng has a sizeable mining division), and the SA government’s cuts to infrastructure spending hurt it badly, but many of its most painful wounds were self-inflicted.

The group, which owns Grinaker-LTA, was fined almost R307 million after colluding on prices for 17 projects.

It also racked up massive debts as it expanded across the world, buying a number of companies, including the Australian-based McConnell Dowell, along the way. Its debts started to bite when the infrastructure market cooled down.

“Aveng is typical of a company that levers up in the boom period, expanding aggressively near the top of the cycle, only to find itself with cash flow issues when the cycle turns,” says Roy Topol, portfolio manager of Private Client Securities at Old Mutual Wealth.

“Debt works wonders by amplifying earnings when things are on the up, but can cause financial distress in a downturn.”

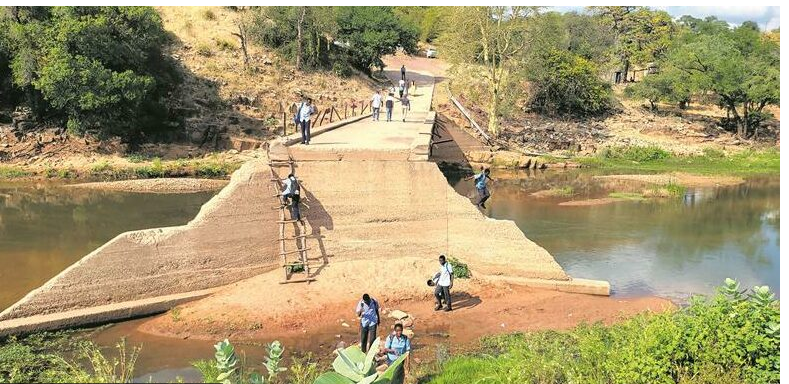

This is Aveng today! Worth only R145m. If it sold all its plant and machinery, shareholders can get some good cash whilst it lasts. If you have the cash, buy it to access the equipment and the CIDB ratings etc. though you will have loads of staff to worry about.

Even with a downturn, Aveng’s woes were avoidable. Topol cites the example of Wilson Bayly Homes, which has weathered the storm well by keeping its strong balance sheet intact through prudent capital allocation.

Aveng’s woes culminated in a R6.4 billion loss in the year to June 2017, with its CEO Kobus Verster resigning on the day it was announced. The company had to get agreement from banks to extend its loans before it could publish its results.

The company started selling assets to help fund the business, but an agreement to sell a majority stake in Grinaker-LTA to Kutana Construction fell through after the black-owned firm failed to get the necessary funding.

The engineering and construction group Murray & Roberts (M&R) recently offered R1 billion to buy Aveng. But the odds are against the deal.

M&R itself is the unwilling target of a hostile bid by its German shareholder Aton. Aton, which owns almost 40% of M&R, does not support the Aveng offer. It is not expected that M&R will get all the other shareholders to agree on the Aveng deal.

“M&R's offer for Aveng may seem like a 'white knight” attempt at bailing out Aveng, but a cynic might view it as M&R's attempt at trying to create a “poison pill” to prevent a hostile takeover by Aton," says Topol. "Either way, M&R's attempt looks likely to be thwarted by Aton, who is not interested in Aveng."

Recent News

Here are recent news articles from the Building and Construction Industry.

Have you signed up for your free copy yet?